Is Relief on the Way? Fed Governor Signals Mortgage Rate Cuts May Be Coming Soon On July 17, 2025, Federal Reserve Governor Christopher Waller made headlines when he said the Fed could begin cutting interest rates “in the next few months”—if inflation continues cooling.

That’s big news for Clarkston homeowners and Metro Detroit buyers feeling the pinch from today’s higher mortgage rates.

Let’s break it down—without the jargon—and talk about what it really means for your mortgage, your budget, and your decision to buy or refinance a home in Michigan.

💬 What Exactly Did Fed Governor Waller Say?

In a speech at the Peterson Institute for International Economics, Waller stated:

“If inflation continues its downward trend, then I believe the [Federal Open Market Committee] can look to reduce the target range for the federal funds rate in the next several months.”

Translation: If prices stay under control, the Fed may start lowering interest rates before the end of 2025.

Waller emphasized that while inflation hasn’t totally cooled, the data is looking better—and the Fed doesn’t want to wait too long and cause unnecessary pain for consumers or the economy.

📉 How Does This Affect Mortgage Rates?

Here’s where it hits home—literally.

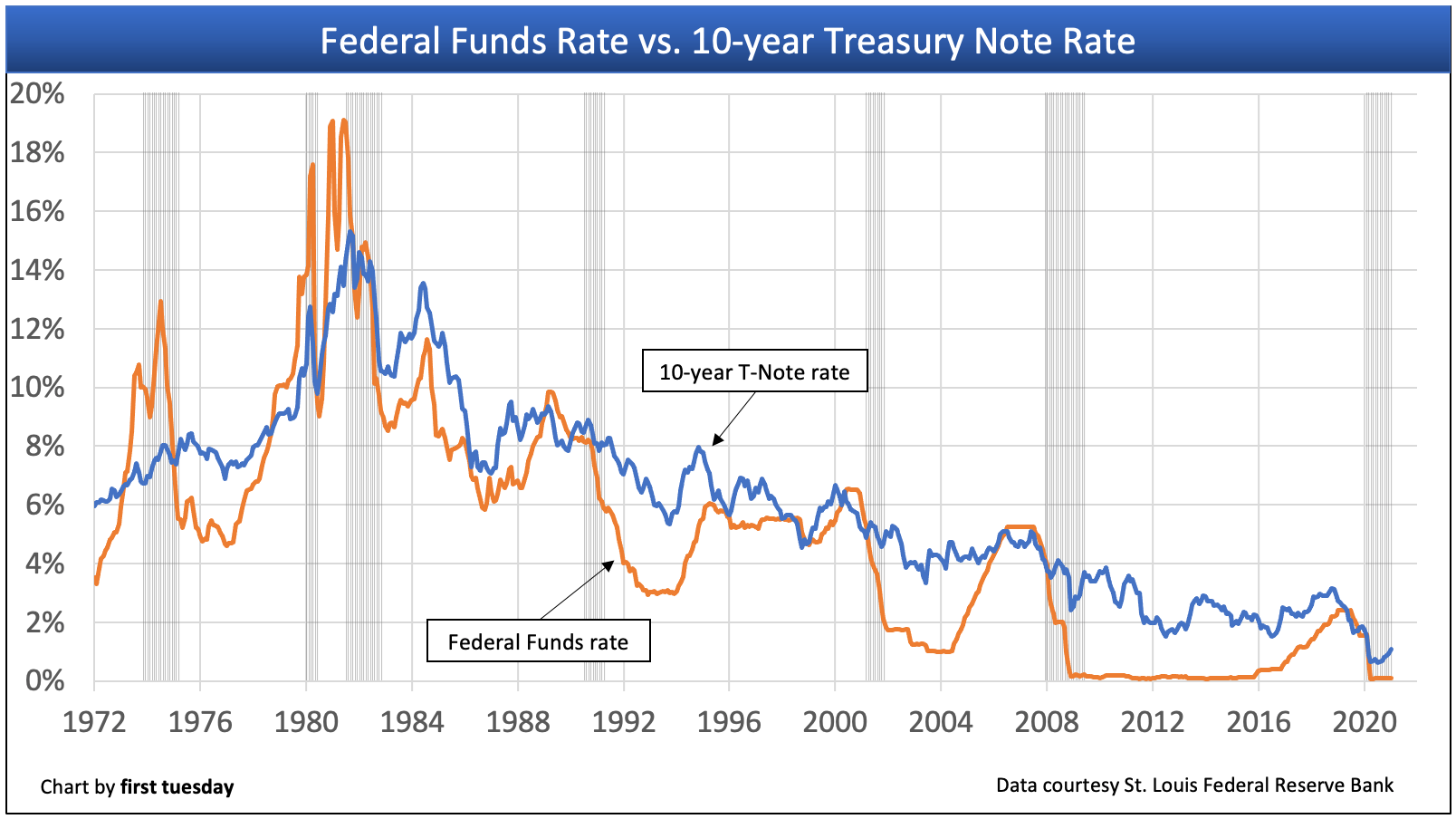

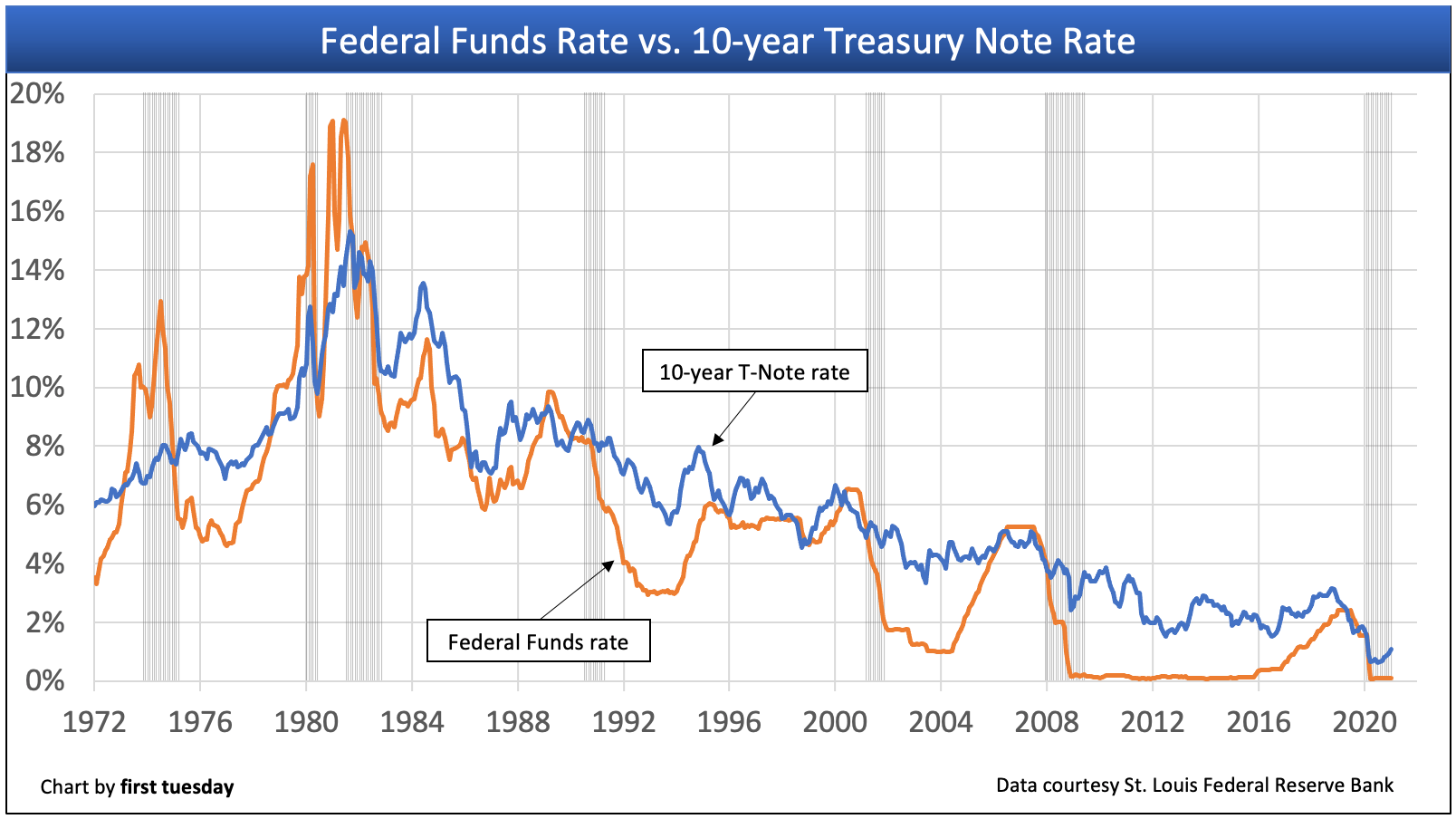

Although the Federal Funds Rate doesn’t directly control mortgage rates, they strongly influence them. When the Fed signals a future rate cut:

Bond markets respond.

Yields on 10-year Treasury notes drop.

Mortgage rates (which follow Treasury yields) tend to move lower.

Since Waller’s speech, we’ve already seen a slight drop in rates, with 30-year fixed mortgage averages falling below 6.6% nationally. In Michigan, we’re seeing some local lenders quoting even lower for well-qualified buyers.

➡️ That means waiting for “the perfect rate” may not be necessary—the opportunity to save is already starting.

🏡 What This Means for Homebuyers in Clarkston & Metro Detroit

If you’re considering buying a home in Clarkston, Waterford, Independence Township, or the greater Oakland County area, here’s what this could mean for you:

✅ Good News:

You might soon qualify for more home—as lower rates improve affordability.

Less competition compared to spring may give you better negotiating power with sellers.

We’re seeing more inventory on the market, giving buyers more options.

⚠️ Caution:

If rates drop too fast, demand could spike again—bringing bidding wars back.

Home prices in Southeast Michigan have held steady, and many areas are still appreciating due to low supply.

The sweet spot may be now—before everyone jumps back in.

🔁 What About Refinancing?

If you bought or refinanced in the last two years and locked in a rate in the 6.5%–7.5% range, you should absolutely be paying attention.

We're starting to see viable refinance scenarios for:

Conventional loans above 6.75%

FHA borrowers with mortgage insurance

Homeowners who want to consolidate debt or eliminate HELOCs

If you’re not sure whether a refinance makes sense, I offer free Total Cost Analysis reviews to run the numbers and show your true savings over time.

🎯 What Should You Do Next?

Whether you're thinking about buying, refinancing, or just trying to time things right—there’s no perfect answer. But there is a smart strategy for every situation.

Here’s what I recommend:

🧭 If You're a First-Time Homebuyer in Michigan:

Lock in a rate now with a lender who offers rate float-downs if rates improve.

Explore down payment assistance and first-time buyer grants available in Michigan.

Talk to a local expert (like me) to map out your numbers clearly.

💸 If You're a Current Homeowner:

Review your current mortgage rate.

Get a personalized refi analysis (not just an online calculator).

Consider whether cash-out refinancing or consolidating other debts is beneficial while home values remain strong.

🤝 Local Guidance You Can Trust

I’m Erik Gascho, a Mortgage Advisor in Clarkston, Michigan with NEO Home Loans, and I specialize in helping Michigan families make smart, financially sound housing decisions.

My job isn’t to “sell you a loan”—it’s to guide you through the market and help you align your mortgage with your long-term goals.

Let’s talk about whether this new Fed news changes your strategy—and how we can make the most of the opportunities ahead.

📅 Let’s Chat

📲 Call or Text: 248-214-8526

📆 Schedule a Call: erikgascho.youcanbook.me

📍 Serving Clarkston, Waterford, Independence Township, Lake Orion, and all of Oakland County